The Crypto Governance Manifesto

Loosely Coupled Governance And Its Effects on Future Economies and States

This post was originally posted on the Amentum blog Aug. 3rd. 2018, and can be found here.

Loosely Coupled Governance, and Growth

I’ve personally been deep in crypto for many years now. Over this time I’ve amassed a multitude of perspectives on cryptocurrencies, specifically on how they should be architected, governed, and secured while being iteratively improved. This post is an attempt to aggregate these many thoughts into a single cogent resource that others can reference and use accordingly. I hope that these views are not exclusively my own — and I thank those who’ve provided me the fodder over the years, as this is an amalgamation of my many peers enlightened ideals.

There have been many discussions lately surrounding the topic of governance, specifically in regards to cryptocurrencies and how or who should dictate the guidance around a protocol’s improvement and architectural decision making.

In crypto, things move fast. One day we’re toying with the concept of crypto+the economics of protocols engineered with incentive mechanisms (which we aptly dubbed, “cryptoeconomics”). And now, with the emergence of new blockchain-based systems that seek to rewrite the rules of “governance”, and others attempting to merge wet-organic rule-making — that is typically laden with governance — with software, these discussions have amplified greatly.

A sound blockchain, one that is scalable, architected using modern software best-practices, built on the most popular languages - blockchains with multiple, working consensus-aware implementations, with the capability to be used in a general purpose manner is a big enough challenge in and of itself altogether. Now, imagine concurrently working to add new features, too. Sound hard? These challenges, as arduous as they may appear, only account for a small portion of governance altogether.

I propose that good governance doesn’t just mean more features; it means cohesive decision making about the features the global community (or a localized population) wants (or needs), in a both a timely and efficient manner.

This decision making — ideally — would be derived from diverse, disparate groups or entities, with various motives and perspectives (foundations/cooperatives, funds, private company researchers). In its ideal form, these motives and varied perspectives would be loosely-coupled from one another, while being tightly-coupled to the sustainable well-being of the protocol itself.

Through their concerted efforts, cooperation and decision-making can be achieved, collectively, and action can be taken accordingly when necessary to ensure the integrity of the blockchain. Because governance and social consensus takes time, and is an emergent property, you want to ensure you create a sound ecosystem that can interoperate well to perceive that emergent consensus & signaling.

The structure I will outline makes three assumptions on the basic foundations a decentralized software ecosystem needs to grow sustainably, and to remain efficiently flexible, while also not being wholly programmatic with regards to on-chain governance:

[Researchers and Private Companies] The protocol needs maintainers, as it must be improved iteratively, so as to be sustainable long-term; those engineers will have a highly-specialized skill set that will need to evolve overtime. The only purpose for these entities is long-term sustainability, and low-level scientific research that continually pushes the protocol to the bleeding-edge (i.e. Starkware).

[Foundations/Cooperatives/Open Source Communities] The protocol needs developers, therefore it needs to incentivize its participants to improve upon it, research, evangelize, and educate others to eventually become core protocol maintainers and developers. They aid in the facilitation of developer conferences, outreach, and maintaining technical documentation, while educating the community on technical roadmaps and improvements.

[Hedge Funds and VC] The protocol needs market speculators and entrepreneurs; capital allocators whose sole purpose is taking the wealth and the tools created, and reinvesting them back into the ecosystem. These protocol capital allocators and speculators play the important role of growing the ecosystem, so it can support a growing developer base — which eventually equates to more highly-specialized engineers researching or creating private companies.

Now that we understand what some of the core pillars of maintaining a decentralized open-source software system are, let’s begin to wrap our heads around what obstacles exist currently for blockchain-related systems.

Governance Layers Existent Today

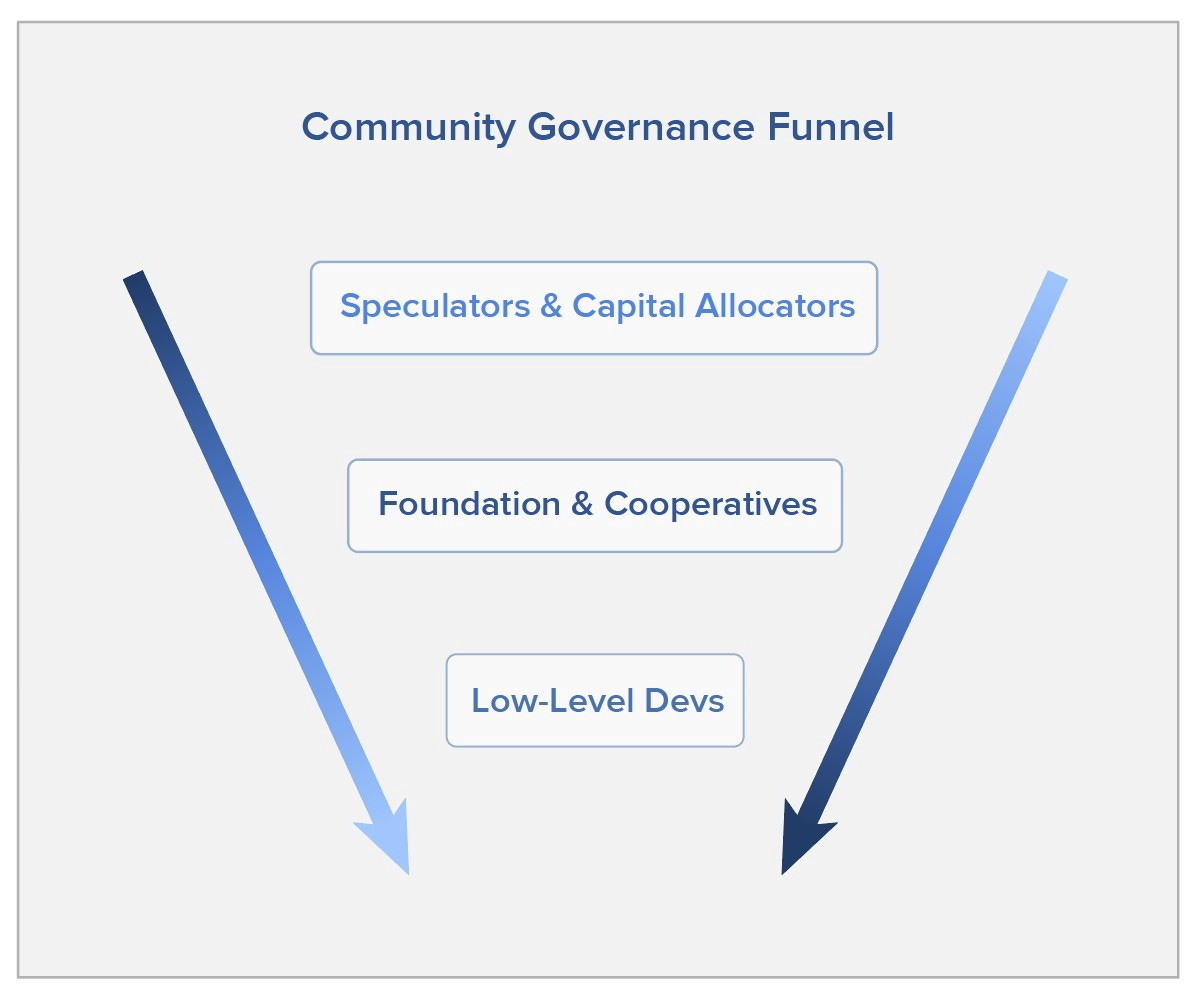

It’s easier to illustrate these concepts with nice graphics. This web shows the interactions between various “governance layers”, how they play into one another, and how each are all inter-related.

When you begin to think about building the best forms of governance, what you first want to ask yourself is “Will my change/system add complexity to the greater decision-making process?”. But, how does one go about determining that?

For most crypto-related systems, off-protocol decision making (layer 0) directly attenuates outward to the other layers, whether we want it to or not. Decisions made in key software engineering collaboration forums (i.e. GitHub, sub-Reddits, technical forums and at developer conferences) play the largest role in determining governance around layer 1 (the consensus mechanism layer, i.e. Casper FFG) and eventually, layer 2 (additional substrates built off the root-chain in layer 1, i.e. State Channels/Lightning).

As you move outward, the number of parties and decision makers becomes fewer, because the layers become more loosely-coupled from the protocol itself as you move up into the additional layers. These are emergent structures (layer 2) that utilize the root-chain itself to provide cryptographic assurances of trust, and allow a chain to scale to new use-cases, without affecting the integrity of the root consensus mechanism (layer 1).

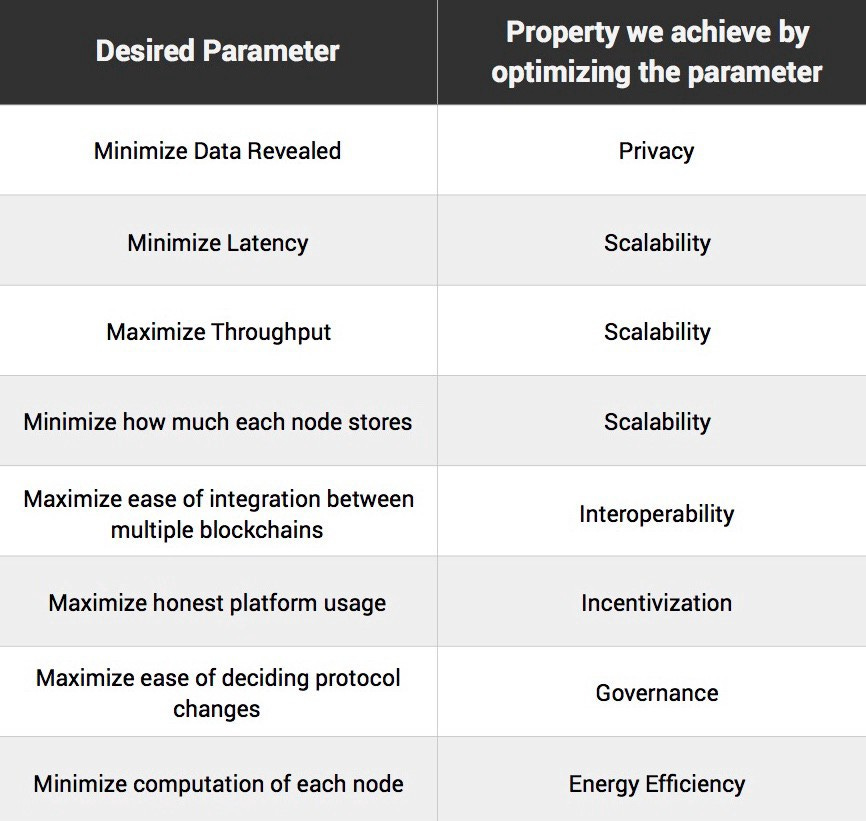

When making changes to the overall blockchain stack (here’s an excellent breakdown of that from the team at Mechanism Labs), there are many considerations to be made.

Borrowing from Mechanism Lab’s post, here’s how changes can be categorized when making determinations on what parameters will be improved in a blockchain, and it’s effect on the system itself:

Image Source: Mechanism Labs

Notice how governance is just one part of how you can modularly improve cryptocurrencies. The only difference is good governance makes augmenting or improving all the other listed parameters far more easy if the processes and stakeholders are appropriately managed.

A Sustainable Crypto Trilemma

To more appropriately align a blockchain-based ecosystem for success, there are various factors that work in tandem to maintain the communities at large — stakeholders, in a more traditional sense.

The stakeholders in a decentralized ecosystem are tricky, because given low switching costs, the general community members can easily move on to “the next big thing” with a few clicks on their local exchange. That said, in order to create a sticky network effect, you have to be very aware of the early contributors and how they’ll eventually scale and mature as the blockchain itself does as well.

This leads us to what I like to call “McKie’s Triangle” (someone said you can’t name your own figures, and I say shove your rules…anyways). This triangle is a figurative illustration of the balancing act that various groups play in a maturing crypto ecosystem.

McKie’s Triangle (in reference to blockchain-based systems) can be defined as followed:

There exists a trilemma when maintaining a public chain protocol, one that requires a multitude of entities working separately in tandem to sustain the protocol itself. Protocol advancement, community stability and growth, as well as speculative and long term value creation, all play major roles in creating a funnel of participants into each of the various groups to maintain a public chain system.

In order to maintain this balance, you want to have loosely coupled entities focused on the key components of pushing a blockchain-based system forward, while remaining tightly coupled to the protocols longevity and sustainability itself.

Each facet offers a different improvement to the network, as illustrated below:

McKie’s Triangle for building sustainable blockchain-based communities.

As depicted by the figure above, speculative value creation, community growth, and protocol advancement all play into eachother. Speculation creates new opportunity; community stability creates a fertile ground for developer resources; and protocol advancement adds to the resiliency of the blockchain itself, allowing the system to improve itself iteratively (and most importantly, securely).

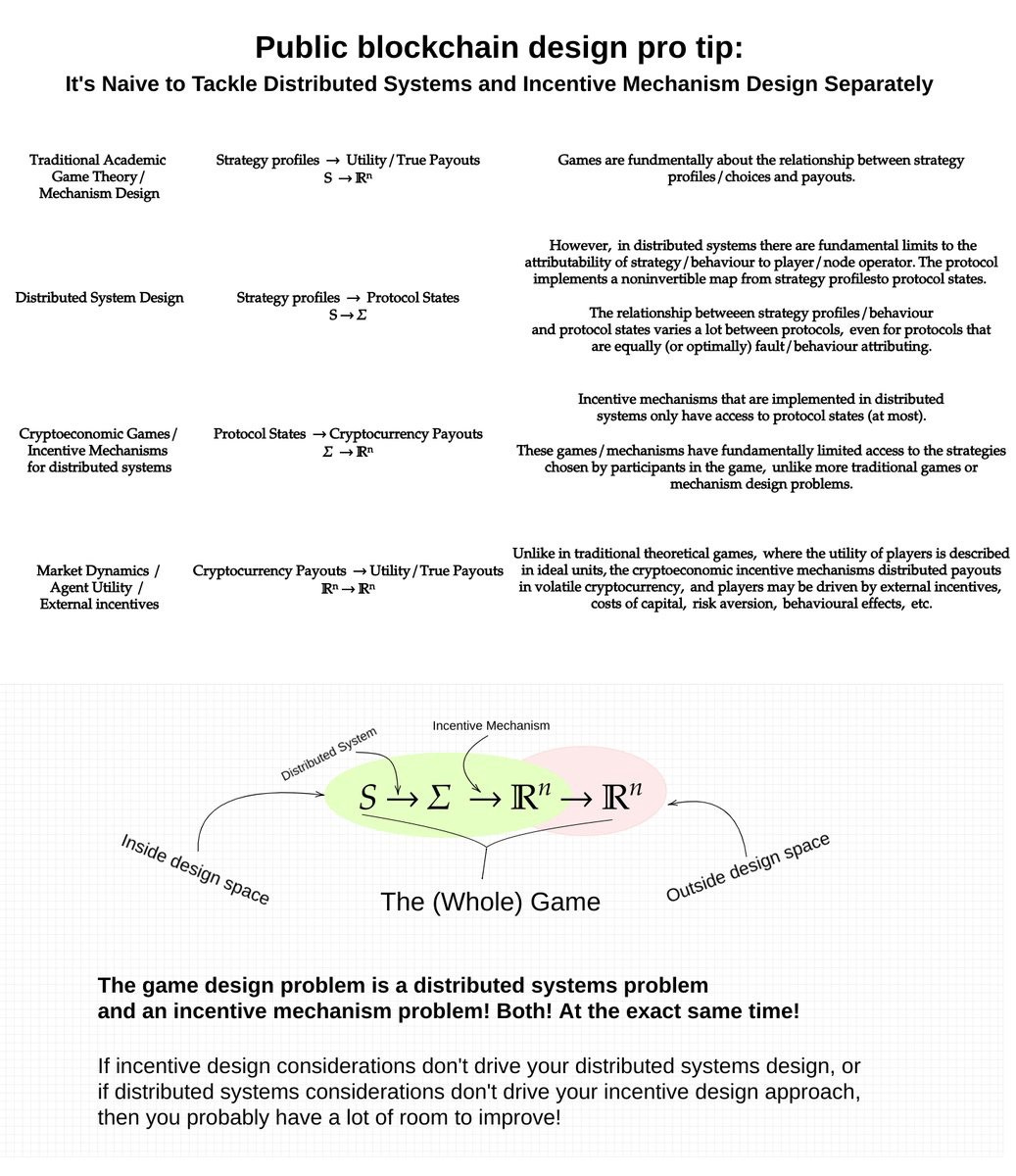

When designing cryptoeconomic mechanisms, too, there are many design decisions that must be considered, showing just how important it is to maintain a diversity of thought early-on. That starts with creating a foundation that can easily and readily support those mechanisms.

As you can see, designing cryptoeconomic systems is a complex game theoretic smorgasbord — it takes a village. Source and image credit goes to Vlad Zamfir.

Programmatic governance, governance naturally derived from blockchain based systems (those with standard Proof of Work sybil-filters, and byzantine fault tolerant consensus mechanisms), enable us to create root chains and an anchor of trust; one that allows us a redundant basis by which to build more complex, interoperable systems (whether that is through Layer 2 solutions like Lightning, Generalized State Channels, Sidechains, etc).

Generalized computational platforms, such as Ethereum, allow you to build the core consensus logic in such a way, that extendability and rich functionality moves up into the additional layers of the stack (i.e. Layer 2). This means DApps or tokens built atop Ethereum are loosely coupled enough such that if you were building a mission critical applications, as long as the core root layer is truly decentralized and secure, you can experiment with a myriad of different combinations of centralized and decentralized services on top, without disturbing the other users of the chain. This allows for ample speculative opportunity, as well as more fertile beds to create new developers (which ultimately aids the long-term feedback loop).

Importance of Loosely Coupled Governance

Now that we understand the structures that are needed for loosely-coupled governance, let’s briefly discuss the importance of experimentation and support for flexible changes to governance structures to meet the needs of a dynamic, ever-evolving populace.

Like an organism, social orders grows and expands based on what its fed, and flexibility is important for security and growth. Loosely-coupled network topologies have existed in theory, but have only recently been capable of existing sustainably in the wild amongst adversarial conditions (i.e. Bitcoin, Ethereum).

However, when we move to make improvements to those systems (either layer 0 or 1), or build new ones atop (layer 2), the ethos of decentralization should hold true — and they too should possess the same resilience (when architected appropriately).

Illustration showing the interactions of various decentralized applications, built to work on top of public chain systems, that utilize the public chain as an anchor of trust (i.e. for fraud proofs).

Modular componentization of service structures creates innate flexibility and creates further extendability for social and economic structures and services; especially those that seek to serve global audiences with various different niche needs and expectations.

Systems that depend on a root chain for fraud proofs and stability are more resilient to tragedy of the commons (low cost to switch, little risk to join); it also aids in the avoidance of monopolistic plutocratic governance models where decisions are tightly coupled to fixed entity sets.

Blockchains are governance. Therefore there must exist embedded checks and balances, otherwise individuals will secede from the union, so to speak, in the form of hardforks (great post on this, here). This comparison between programmatic governance that is non-contentious can be analogous to the tenants outlined formally in the U.S. constitution. Of which, our current laws are built and interpreted — flexible, freedom expanding governance, derived from words written on paper (held in place by the imagined order that is the United States of America).

Think of loosely-coupled applications and systems built atop these root chains as individual cities and states. Where, if a citizen deems a certain state insufficient to their needs or liberties, they can easily move to another that is more sufficient for their well-being.

What we are seeing here, is the slow evolution from States that are tightly-coupled to legal entities (Federal governments) to the dependence on state-machines built on blockchains that can provide you the utility and access to services you deem most useful to your personal independence, similar if not better than those of the existing legacy state.

Risks of Oligopolistic Mining Cartel Collusion and Its Long-Term Effects on the Political State

Understanding the importance of loosely-coupled statehood is important in realizing my next point which is in regards to mining cartels and collusion.

When you have a decentralized protocol with a novel PoW (i.e. SHA256, ETHHash, Equihash, etc), it’s important that the core security of that system — especially initially — has the flexibility and time to maintain as much distributed support globally as possible.

Ethereum and ZCash saw the formation of major mining entities and acted accordingly when developing their PoW algorithms. Now, with the proliferation of mining economies of scale, the barrier to entry for new chains is even higher given the potential onslaught of miners throwing cash to develop ASICs for every new major asset based on some substantial/reasonably secure cryptographic hashing algorithm.

The folks from the Sia team did a very thorough analysis on this that outlines this potentiality with the formation of mining cartels, here.

An excerpt that sums up things quickly from the Sia team:

“We know of mining farms that are willing to pay millions of dollars for exclusive access to designs for specific cryptocurrencies. Even low ranking cryptocurrencies have the potential to make millions in profits for someone with exclusive access to secret ASICs. As a result, an informal underground industry has been set up around secret mining. The heavy amount of secrecy involved means it’s disconnected and mostly operates off of rumor and previous relationships.”

If a miner controls an economy of scale (i.e. PoW hardware manufacturing), they ultimately control the liquidity/velocity flow of the State/Federal level cryptos that are derived from those root chains, given a lack of market competition. Therefore, direct influence over said monopolistic entities are then tightly-coupled to future tokenized cities/states, which means that entire political-monetary interfaces, globally, if adopted and built upon, could be centralizing governance in ways many might not immediately realize — until it’s too late.

Many of us have exclaimed for years that PoS (Proof of Stake) was one of the only ways forward. An early lead in crypto PoW mining allowed the earlier miners to take advantage of inefficiencies that PoW assets provided them, entrenching their competitive advantage through economies of scale.

Hardforks, secret mining cartels and more have exasperated this further, with the help of geopolitical pressures, access to cheap manufacturing, energy, and brigading to prevent new competitive entrants, it continually compounds. The best way forward would be to reduce the dependency on PoW and hybridize more systems with periodic PoS validations to slowly stymie the IV drip of PoW mining profits to major miner manufacturers (PoS researcher Vlad Zamfir has been a big proponent of this, historically).

The decentralization of mining can be made more competitive, faster, if we make it more advantageous for the growth of new outfits that compete on par with current incumbents given continued in-protocol limitations and improvements that further distribute that power and financial upside outward.

There needs to be a balance for PoW to scale now between new manufacturing entrants, infusion of fresh capital, and back room trade deals pushing PoW to decentralize globally at this point in the growth of our nascent industry, for things to continue to proceed smoothly.

One major point of note: These large mining entities know that PoW won’t be their ace card forever. They’ve diversified with masternodes on various upcoming/existing chains, and have PoW/PoS agnostic pools for this very purpose to ensure their network effects and influence grows and/or sustains for the long-term. Tread carefully.

Prime Conditions for Miner Collusion

Some of the prime conditions for market collusion in oligopolistic markets can be described as:

Number of Active Firms: The greater the concentration of major market participants in an industry, the higher the incentives are to collude (to boost profits in a highly-competitive market). This ensures there are greater profits, while at the same time distributing those profits to fewer firms.

Informational Transparency: Given a transparent market with perfect information, it becomes easier to ensure that firms participating in collusion are following the agreed upon strategy. Collusion is more difficult in industries where its harder to detect changes in a firm’s prices or output; due to the nature of cryptocurrencies, however, the majority of all this information is easily accessible and quantifiable.

Multimarket Contact and Coopetition: If miners compete for hashrate in more than one blockchain, collusive agreements become even more stable and scalable. Firms that compete together in many markets can establish multi-trigger strategies that can be applied to these markets — which when combined with control and influence over exchanges and stable-assets — creates an even more sustainable and devastating strategy for non-participating market competitors.

When you expand beyond PoW to other more experimental consensus mechanisms like EOS’s dPoS, things get even more interesting. However, that falls outside the scope of this essay — we did a light analysis of how we thought EOS would play out, here (spoiler: we were right). We’d also suggest this post by Vitalik Buterin on plutocracy, and this tweet thread by Nick Szabo.

Experimentation and Goal-Seeking

Social primitives, or the shared common beliefs of the participants of a system, will fall redundantly to the lowest common denominator in times of social and political duress. In crypto and Blockchain-based systems, that is codified trust and entropy — Proof of Work (or Proof of Stake/hybrid systems).

Systems built on technical foundations that serve as bad behavioral black holes means that overtime — through motivations of grandeur and greed — participants in that system will inevitably trend towards those norms as a means to acquire more resources as a means to concentrate wealth, compounded over the lifetime of the chain (much like how if the most successful of individuals attended college, and worked 40hrs a week, the majority will follow that trend until that system becomes unsustainable, because that wealth creation practice is a zero-sum game, on a long enough time-scale).

The trustless and decentralized technical components of cryptocurrencies dont just serve a use because they’re fast, fair, secure and efficient — they also promote similar tenants outwardly into what’s eventually built on top on the additional substrates via layer 2 and various other forms of middleware.

Lack of ambiguity over an agreed upon state (either meatspace organic or a patricia trie) builds externalized trust overtime as history moves forward and participants mature with the system itself, whether it’s religious structure and an agreed upon social state of norms, or a financial one like a centralized monetary system. Studies have shown that when there is a lack of ambiguity around trust, people are more apt to cooperate efficiently — governance via blockchain-based systems allow the creation and proliferation of those trust-less systems..

Avoidance of Crypto Authoritarians

We want to avoid the further entrenchment of centralized bodies like banks and governments who may seek to leverage blockchain-based technologies to harden and further push their ulterior strategies and advance their control further. Central banks and governments will be some of the first participants seeking to garner this control (i.e. the Venezuelan Petro token), automating their control.

Decentralized marketplaces and prediction markets (see the drama around Augur killing their kill-switch) could serve to empower criminal activities more, but it’s my firm belief that positive use-cases of crypto outweigh the negative, and try as you might, criminals are going to attempt to leverage systems to increase their own wealth — they’ll just have to get more creative (and technically proficient).

That’s why it’s important we continue to grow our network of subject matter experts and protocol-level researchers who are competent to provide us the insights and innovations to steer this ship as it sails forward, with the winds of good-faith effort, using the structures and initiatives I described earlier.

Embracing the Good Through Governance

Our challenge as a growing industry is for us to find a way to extract the good that technology and new social systems can afford us, without enslaving ourselves to their potentially burdensome by-products or dystopic perspectives.

The overall Ethereum community shows a good faith effort towards this with the Ethereum Magicians initiative as they work to improve their layer 0 governance structure; I think this is a vector of decentralization that all major public chains should research as a community.

If we can work to follow similar guidelines as I’ve described, perhaps we will realize that vision many of us possess of a truly connected P2P society. By solving scaling and interoperability, our most powerful and prolific machines can be decentralized in nature. Loosely-coupled, dynamic, hyper-localized networks that provide storage and interoperably-linked computation to everyone with a connected device.

By tokenizing novel, human-meaningful systems, we can grow and mature these tokenized ecosystems more efficiently, while allowing other individuals the range and right to tokenize their own innate skills, interest, and self-actualize through their own passions.

With the rise of tokenized ecosystems, blockchain-based governance, and a focus on speculative value creation and capture, we can build to make humanity unstoppable, and resilient, while making us more capable of resisting violent power structures. This protects our long-term viability with the creation of new redundant systems that enable us to more easily bounce back from major catastrophic events.

The thermodynamics of the human economy and the creation of value and money has reversed in the favor of human independence and self-actualization; rather than live in world where you are a liability, burdened with the need to create more output than you consume inputs — the very blockchain-based systems you interact with and join in the future will allow you to move from a liability, to an asset where value flows to you from your individual inputs — allowing you the capability to truly be free.